Crowdfunding Has Never Been This Easy

Invst Guru is your bi-weekly digest that explores the dynamics of equity crowdfunding. Delivered every Tuesday and Sunday, we connect startups with the power of the crowd, providing investors with access to groundbreaking ventures.

In each issue of Invst Guru, we'll spotlight the latest trends, share success stories, and offer insights from industry leaders. We aim to equip you with the knowledge and opportunities to participate effectively in equity crowdfunding, whether you're looking to fund your innovative startup or invest in potential unicorns.

🧘♂️ Equity Crowdfunding Deal In Focus 🧘♂️

A Regulation CF offering featuring a premium men’s basics brand focused on high retention and unit economic efficiency.

Editor's Note

This profile is for informational purposes only and does not constitute personalized investment advice, legal advice, or a recommendation to buy or sell securities. Investment in crowdfunding offerings involves significant risk, including the potential loss of your entire investment. Investors must conduct their own due diligence and review the company's Form C and official offering statement available on the Wefunder platform before making any investment decisions.

Company Overview

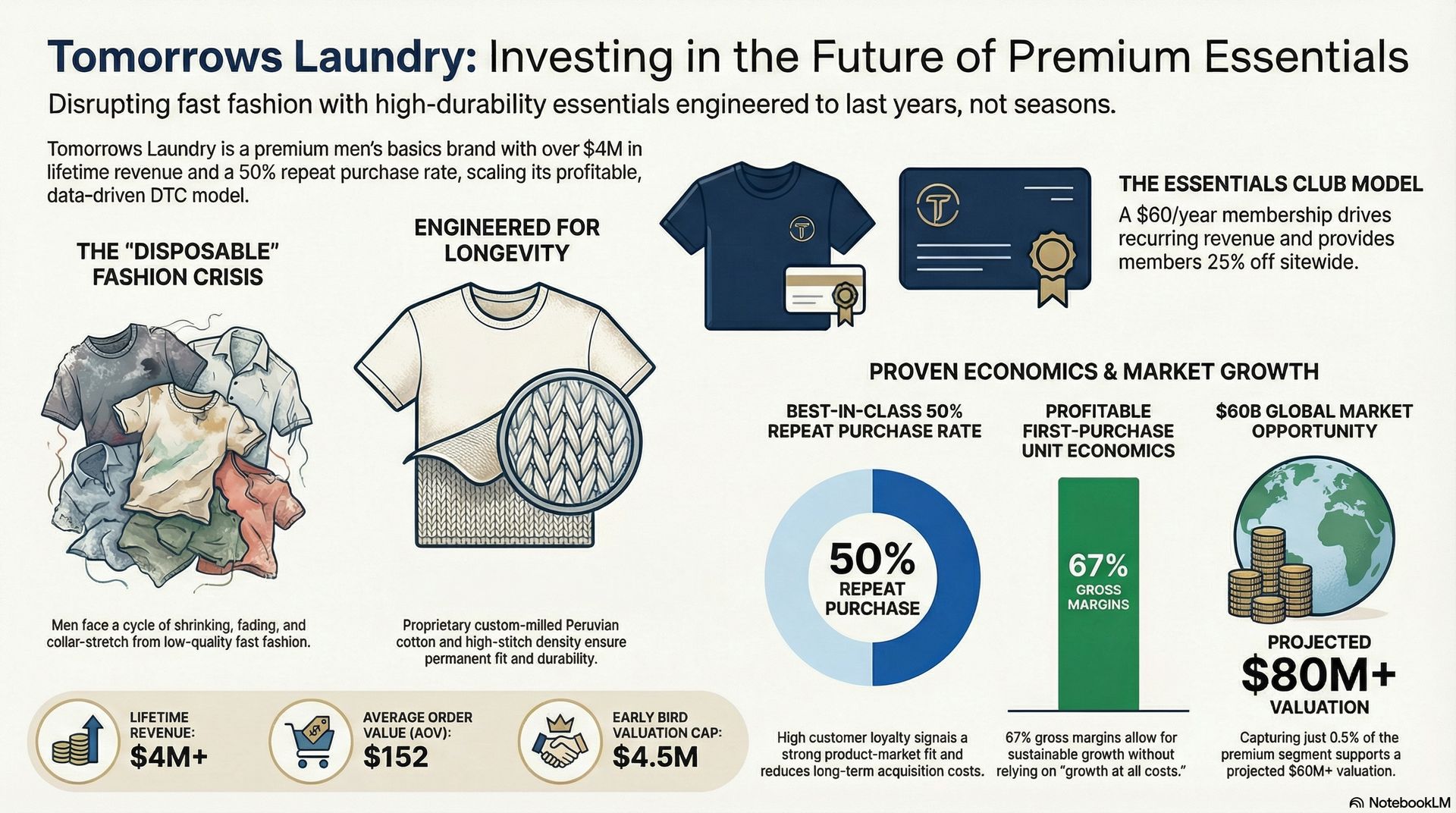

Tomorrows Laundry is a premium men's apparel brand specializing in high-durability essentials. The company reports using custom-milled Peruvian cotton to create pre-shrunk, engineered basics that align with a 'buy less, buy better' philosophy. Based in the United States, the company operates primarily through a Direct-to-Consumer (DTC) model and a proprietary essentials membership club. The leadership team is led by Founder Robert Eala, who brings a reported track record of driving over $100M in apparel sales throughout his career. He is supported by COO Ahmed Ali, Creative Media Director Benjamin Gagliardi, and Finance Advisor Jeremy Cervantes. The company has also secured advisors from the kitchenware brand HexClad. Tomorrows Laundry focuses on high-quality manufacturing and recurring revenue streams to distinguish itself within the competitive fashion retail landscape.

The Problem Tomorrows Laundry Addresses

The company seeks to address two primary issues in the contemporary men's apparel market: the 'disposable' nature of fast fashion and the lack of consistency in premium basics. Management suggests that many consumers are frustrated by high-priced clothing that shrinks or loses shape after a few washes. By utilizing high-density Peruvian cotton and pre-shrinking processes, the company aims to provide a durable alternative that maintains its fit and quality over time. Furthermore, the brand addresses friction in the shopping process for basic staples by offering a membership model that automates wardrobe building for professionals and style-conscious men who value time efficiency and physical longevity in their garments.

Product and Platform

The core product line consists of classic essentials, including t-shirts, hoodies, and sweatpants, all designed with a modern fit and heavyweight fabric. The company highlights its use of custom-milled Peruvian cotton, widely recognized in the industry for its softness and durability. A central component of the brand's platform is its 'Essentials Club,' a membership program that encourages recurring purchases and rewards customer loyalty. Beyond the digital storefront, the company takes a data-driven approach to product development, using customer feedback to refine fit and color options. The platform is designed to facilitate a high Average Order Value (AOV), which management reports currently stands at $152, supported by bundled offerings and high-quality product photography that emphasizes the 'premium' nature of the brand.

Operating History

Since its inception, Tomorrows Laundry has achieved over $4M in lifetime revenue. The company reported $1.7M in revenue for 2024. According to management disclosures, the business has shifted its focus toward operational efficiency and profitability. While previously focused on top-line growth, the 2025 strategy emphasizes positive operating profit, with $1M in revenue targeted for the year under a more streamlined cost structure. This pivot reflects a broader trend in the DTC space away from 'growth at all costs' toward sustainable unit economics. The company has successfully built a customer base of over 11,500 lifetime customers and maintained a 50% repeat purchase rate, which serves as the foundation for its current expansion efforts.

Strategic Focus

The company’s current strategic emphasis is on scaling its profitable core while expanding into adjacent product categories. Management intends to leverage its existing customer trust to launch new essentials, including socks and underwear, which typically carry high replacement cycles. A significant portion of the strategy involves optimizing digital marketing spend to maintain its 'first-purchase profitability' status. By focusing on a specific niche—men who prioritize quality over brand-name flash—Tomorrows Laundry aims to deepen its market share through targeted social media advertising and influencer partnerships. The 2026 revenue forecast of $2.6M is based on the successful execution of these category expansions and continued high retention rates within the Essentials Club.

Business Model Overview

Tomorrows Laundry operates a DTC e-commerce business model with two primary revenue streams: one-time transactional purchases and a recurring membership club. The company reports strong unit economics, with a 67% gross margin. Management states that the company is profitable on the first purchase, a key metric in the DTC industry that reduces reliance on venture capital for customer acquisition costs. Revenue is driven by an AOV of $152, which is significantly higher than that of many fast-fashion competitors. By controlling the supply chain from Peruvian mills to the end consumer, the company captures a larger portion of the value chain. The path to long-term sustainability relies on maintaining these margins while increasing each customer's lifetime value (LTV) through expanded product offerings.

Market Context

The premium basics market is highly competitive and fragmented. Tomorrow’s Laundry competes with established venture-backed players like True Classic, Cuts, and Buck Mason, as well as heritage brands. The market is shifting toward 'quiet luxury' and sustainable consumption, favoring brands that emphasize durability. However, the barrier to entry for new apparel brands is relatively low, resulting in high saturation across digital advertising channels. Tomorrows Laundry positions itself between mass-market retailers and ultra-luxury brands, targeting the 'attainable premium' segment. Success in this context requires not only product quality but also strong brand affinity and efficient logistics to compete with larger incumbents.

Use of Funds

According to the offering disclosures, the company intends to use the proceeds for: Inventory expansion to support new product lines and stock consistency; Marketing and customer acquisition to scale the Essentials Club; Research and development for new fabrications and styles; and General working capital to support operational overhead.

Offering Structure

The company is offering securities through a Regulation CF (Crowdfunding) campaign on the Wefunder platform. The investment vehicle is a SAFE (Simple Agreement for Future Equity). The company has set a funding goal of $625,000 with a minimum investment of $100. Early bird investors are offered a valuation cap of $4.5M on the first $150,000 invested, after which it increases to $5M. A SAFE represents a right to future equity in the company upon certain triggering events, such as a future priced financing round or a sale of the company. Investors should note that a SAFE is not debt or common stock and carries specific risks regarding the timing and certainty of conversion into equity.

Bull Case 🐂

Why Some Investors Find the Company Interesting

• The 50% repeat purchase rate suggests strong product-market fit and high customer satisfaction.

• Management reports 67% gross margins and profitability on the first purchase, which is superior to many DTC peers.

• The founder has significant industry experience, having previously managed brands with over $100M in cumulative sales.

• The low entry valuation cap relative to lifetime revenue may offer a more attractive entry point than typical seed-stage startups.

Bear Case 🐻

Why Risk Remains

• The premium basics market is intensely competitive, with rivals possessing significantly larger marketing budgets and greater brand recognition.

• The company is dependent on the cost and availability of Peruvian cotton, making it vulnerable to supply chain disruptions, geopolitical instability, or climate-related crop failures.

• Future growth is heavily dependent on the efficiency of digital advertising; rising costs of customer acquisition could materially compress margins and impact liquidity.

• Expansion into new product categories involves significant inventory risk, including the potential for unsold stock and capital tied up in slow-moving goods.

• Investment in this offering is speculative and involves a high degree of risk; investors should be prepared for the possible loss of their entire investment.

Final Perspective

According to company disclosures, Tomorrows Laundry has reported over $4M in lifetime revenue and a loyal customer base. The company states its focus on 'high-durability' and 'first-purchase profitability' is intended to distinguish it from capital-intensive apparel startups. Management reports a 50% repeat purchase rate, indicating the company has established a niche among consumers seeking quality over fast-fashion alternatives.

However, potential investors must weigh these reported strengths against the inherent risks of the fashion industry, including shifting consumer tastes, supply chain vulnerabilities, and the high cost of acquiring digital customers. The company's goal of transitioning to a consistently profitable operating model in 2025 is a forward-looking statement and represents a critical milestone that may not be achieved. This content is for informational purposes only and does not constitute personalized investment advice. As with any early-stage investment, there is no guarantee of returns or future performance. We strongly encourage all interested parties to thoroughly review the company's Form C, financial disclosures, detailed Risk Factors, and the specific terms of the SAFE agreement on the Wefunder platform before committing capital.

Investing in startups is speculative, involves a high degree of risk, and investors should be able to bear the loss of their entire investment. All investments must be made through the registered funding portal.

⚖ Required Footer Disclaimer

This newsletter is for informational purposes only and does not constitute investment advice or a solicitation to invest. Invst Guru is not affiliated with Tomorrows Laundry, Wefunder, or any broker-dealer. Any investment in private or early-stage companies involves risk, including the potential loss of your entire investment. All investments in Tomorrows Laundry must be made through its official campaign page on Wefunder. No investment terms are included in this newsletter. For full offering details, risk factors, and disclosures, please review the company's official Form C filing and offering page.