Crowdfunding Has Never Been This Easy

Invst Guru is your bi-weekly digest that explores the dynamics of equity crowdfunding. Delivered every Tuesday and Sunday, we connect startups with the power of the crowd, providing investors with access to groundbreaking ventures.

In each issue of Invst Guru, we'll spotlight the latest trends, share success stories, and offer insights from industry leaders. We aim to equip you with the knowledge and opportunities to participate effectively in equity crowdfunding, whether you're looking to fund your innovative startup or invest in potential unicorns.

🧘♂️ Equity Crowdfunding Deal In Focus 🧘♂️

Editor’s Note

Harmony Baby Nutrition is conducting a Regulation Crowdfunding offering. This newsletter is for informational purposes only and does not include investment terms. All investments must be made exclusively through the company’s official offering page on a registered funding portal. Prospective investors should review the Form C, offering materials, and risk disclosures before making any investment decision.

The Human Milk Problem Few Companies Address

An estimated one in five babies cannot tolerate standard infant formula. Parents often describe feeding as a cycle of trial and error marked by digestive distress, feeding refusal, and anxiety during critical developmental months.

Most hypoallergenic formulas aim to address this problem by removing potential allergens. They strip allergenic proteins from cow’s milk and replace components with industrial carbohydrates to maintain calories. While this approach addresses allergy exposure, it often introduces new challenges related to taste, smell, and the absence of bioactive components found in human milk.

Harmony Baby Nutrition approaches the problem differently. Rather than modifying cow’s milk, the company designs formula using human milk as a biological reference point. This distinction underpins its product development strategy and informs how investors evaluate the company within the equity crowdfunding landscape.

Why Equity Crowdfunding Matters

Equity crowdfunding has expanded access to early-stage investing. Opportunities once limited to venture capital firms and accredited investors are now available to the public through Regulation Crowdfunding.

This expansion brings benefits and risks. Investors gain exposure to emerging companies and technologies. Companies gain access to a broader base of capital and community support. At the same time, these investments involve high risk, limited liquidity, dilution, and long timelines.

Harmony Baby Nutrition provides a useful case study for evaluating both the potential and the limitations of equity crowdfunding as an asset class.

Company Background and Team

Harmony was founded by Wendel Afonso, a longtime operator in pediatric nutrition. Over two decades, he launched more than 30 specialized infant and toddler nutrition products in Brazil and previously built INVITA Specialized Nutrition into a fast-growing regional business.

The broader team includes food scientists and pediatric specialists with experience at organizations such as Nestlé, Gerber, Harvard, Mass General, Baylor College of Medicine, UC Davis, and the University of Rochester.

In infant nutrition, regulatory scrutiny, clinical credibility, and trust are central. A team with experience across science, regulation, and commercialization reduces execution risk relative to first-time operators, though it does not eliminate it.

Formulation Philosophy

Harmony’s formulation strategy focuses on replicating the functional aspects of human milk rather than incrementally altering cow’s milk.

Key formulation elements include:

Lactose is the primary carbohydrate, reflecting human milk composition and infant digestive biology.

Extensively hydrolyzed milk proteins designed to reduce allergenicity while preserving palatability.

Inclusion of human milk oligosaccharides at levels permitted by regulation, supporting gut microbiome development.

A proprietary oil blend designed to approximate the fatty acid profile of human milk, including DHA and ARA.

Exclusion of corn syrup, table sugar, and maltodextrin.

This approach is supported by multiple patent filings and extensive prototype testing. Intellectual property protection and technical differentiation are important considerations for early-stage companies, particularly in markets dominated by large incumbents.

Market Entry Strategy

Harmony plans to enter the market with a toddler formula product before expanding into infant formula.

Toddler formulas face lower regulatory barriers and do not require infant clinical trials at launch. This sequencing allows the company to validate manufacturing, supply chain reliability, and market acceptance before pursuing the more complex infant category.

The initial product, Melodi, is expected to launch following additional development and regulatory preparation. Expansion into infant formulas would require clinical trials and additional regulatory review, increasing both time and capital requirements.

This staged approach reduces early risk while extending the overall timeline for broader market participation.

Market Context

The global infant nutrition market exceeds $100 billion annually. In the United States, most infants consume formula within the first six months of life.

Hypoallergenic formulas represent a meaningful subset of this market, driven by medical need rather than consumer preference alone. Once a formula is tolerated, switching rates are typically low, which can support recurring demand.

Market size alone does not determine outcomes. Execution, clinical performance, pricing, distribution, and competitive response are decisive factors.

Traction and Prior Funding

Prior to launching its Regulation Crowdfunding campaign, Harmony raised capital from venture firms and grant programs focused on food and nutrition innovation. These investors conducted their own diligence and provided early validation of the company’s approach.

Professional backing reduces certain early risks but does not guarantee commercial success or future fundraising.

Understanding the Crowdfunding Structure

Harmony is raising capital through a SAFE, a common structure used in early-stage financing.

A SAFE is not equity. It represents a contractual right to convert into equity in a future priced financing, subject to the terms outlined in the offering documents. Conversion depends on future events, which may not occur.

SAFE holders typically have no voting rights, no dividends, and no liquidity until a conversion or liquidity event, if any.

Investors should review the specific SAFE terms, risk factors, and dilution scenarios disclosed in the Form C.

Competitive Landscape

The infant nutrition market is dominated by multinational companies with extensive manufacturing, regulatory, and distribution capabilities.

If a smaller company demonstrates traction, incumbents can respond by applying pricing pressure, introducing competing products, or making acquisitions. Differentiation through formulation science and clinical credibility may provide an advantage, but speed and execution remain critical.

Potential Outcomes and Risks

Positive outcomes depend on successful product launches, regulatory progress, adoption by parents and pediatricians, supply chain stability, and sufficient capital to execute the roadmap.

Negative outcomes include manufacturing delays, regulatory setbacks, slower adoption, competitive pressure, or inability to raise additional capital. In such cases, early-stage investors risk partial or total loss of invested capital.

These scenarios are common across early-stage companies and should be considered carefully.

Valuation Context

The valuation implied by the SAFE reflects expectations about future development rather than current revenue. Early stage valuations involve judgment rather than precise calculation.

Investors typically assess whether the team, differentiation, and market opportunity justify the valuation relative to the associated risks and time horizon.

Regulatory Considerations

Infant and toddler nutrition is heavily regulated. Ingredient approvals, labeling requirements, and clinical evidence standards are stringent.

Delays or changes in regulatory requirements can materially affect timelines and costs. Regulatory risk remains a central factor in this category.

A Framework for Evaluation

When evaluating any equity crowdfunding opportunity, investors often consider:

Founder and team experience.

Product differentiation and defensibility.

Market size and timing.

Competitive dynamics.

Regulatory complexity.

Capital requirements and dilution risk.

Liquidity pathways and time horizon.

Personal risk tolerance.

Equity crowdfunding investments are speculative and illiquid. Diversification across multiple opportunities is commonly recommended.

Final Perspective

Harmony Baby Nutrition represents a science-driven approach to a regulated and emotionally sensitive category. The company addresses a clear clinical need with a differentiated formulation strategy and an experienced team.

At the same time, the business faces the realities common to early-stage nutrition companies: long timelines, regulatory complexity, capital intensity, and strong incumbents.

This opportunity will not suit every investor. It may appeal to those who understand early-stage risk, long holding periods, and the inherent uncertainty in product-driven healthcare-adjacent markets.

To learn more about the company and access official offering materials, visit Harmony Baby Nutrition’s Regulation Crowdfunding page on its registered funding portal.

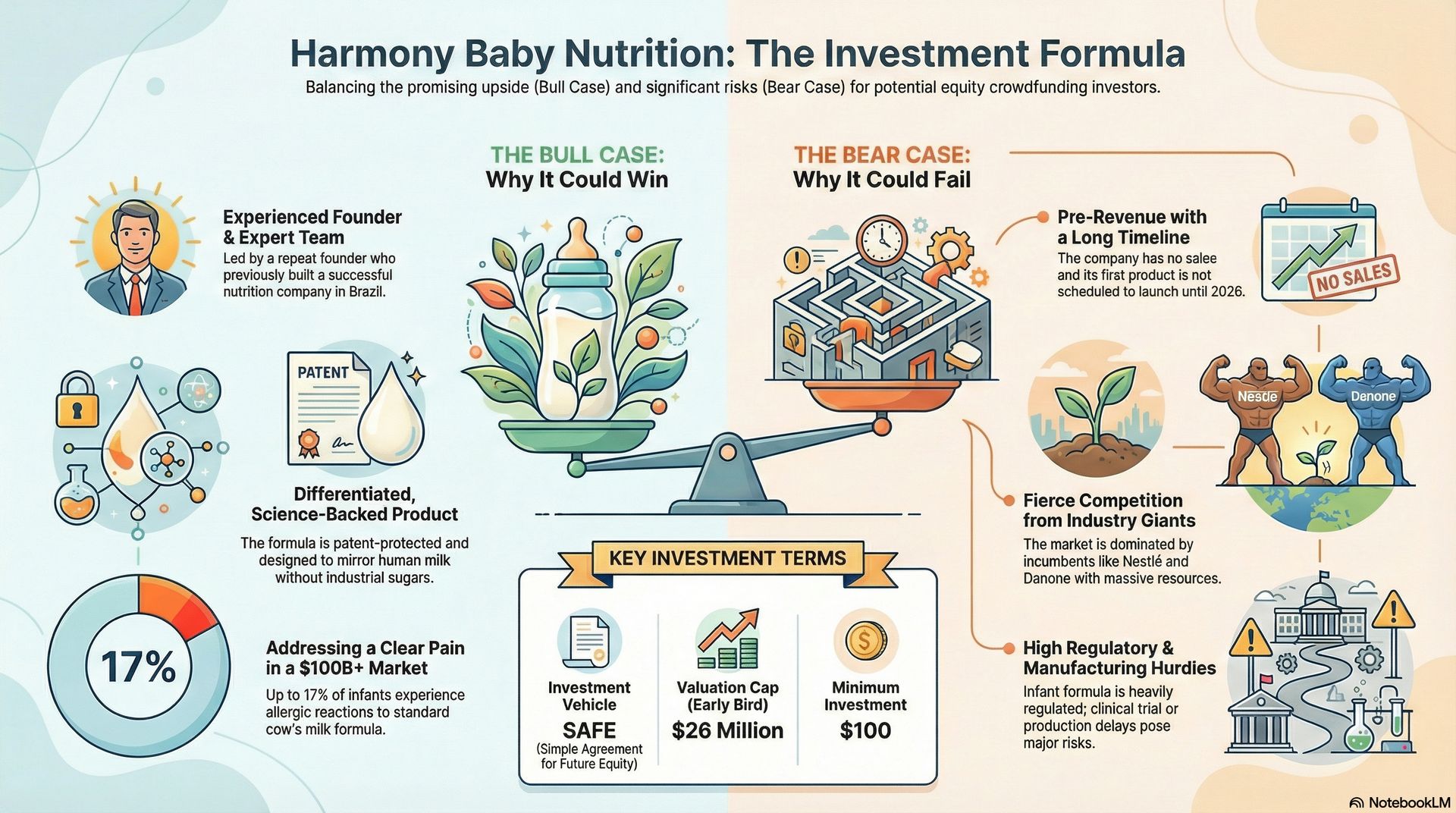

Bullish Factors 🐂

• Experienced repeat founder with relevant operating history. Wendel Afonso previously launched more than 30 infant and pediatric nutrition products and built a fast-growing nutrition business in Brazil. Prior execution experience lowers certain operational risks compared to first-time founders, though it does not eliminate risk.

• Depth of clinical and regulatory expertise uncommon for early-stage consumer nutrition companies. The team includes pediatric allergy and gastroenterology specialists from institutions such as Harvard and Mass General, as well as former executives from Nestlé, Gerber, Pfizer, and Wyeth. This background supports regulatory navigation and product development in a highly regulated category.

• Clearly defined clinical pain point within the hypoallergenic formula segment. A meaningful percentage of infants experience intolerance to standard formula, driving demand for specialized alternatives. Pediatric feedback cited by the company indicates interest in differentiated formulations, though broader adoption remains unproven.

• Platform-based formulation strategy. A shared scientific foundation supports multiple potential products over time. The initial toddler formula launch allows validation of manufacturing, supply chain, and market response before pursuing infant formulas, which face higher regulatory requirements.

• Prior institutional funding before the crowdfunding round. Venture firms and grant programs focused on food and nutrition innovation provided approximately $13.5 million in prior capital. This reflects third-party diligence and early validation, but does not predict future performance or funding outcomes.

• Historical acquisition activity in medical nutrition. Large incumbents such as Nestlé, Danone, and Reckitt have previously acquired pediatric and medical nutrition assets. These transactions demonstrate strategic interest in differentiated products, but do not indicate expected outcomes for this company.

Bearish Factors 🐻

• No commercial revenue to date. The company has not yet launched products or demonstrated sustained market adoption. All forward plans depend on the successful execution of manufacturing, regulatory compliance, and distribution.

• Extended timeline to scale. The planned toddler launch is an early step. Expansion into infant formula requires clinical trials and regulatory review, which will extend timelines by several years and increase capital requirements.

• High regulatory and quality control burden. Infant and toddler nutrition is subject to strict safety, labeling, and manufacturing standards. Any quality issue, clinical setback, or regulatory delay materially affects cost structure and timelines.

• Competitive pressure from global incumbents. Established players control most of the market and benefit from scale, distribution reach, and brand trust. Competitive responses to new entrants often occur quickly and aggressively.

• Valuation based on future development rather than current cash flow. The valuation caps reflect expectations about long-term platform execution, not existing revenue. Investor outcomes depend on successful execution across multiple stages and on an eventual liquidity event, both of which are uncertain.

• Illiquidity and long holding period. SAFE instruments depend on future financing or liquidity events for conversion. Even after conversion, equity remains illiquid. Capital invested should be considered long-term and subject to total loss.

⚖ Required Footer Disclaimer

This newsletter is for informational purposes only and does not constitute investment advice or a solicitation to invest. Invst Guru is not affiliated with Harmony Baby Nutrition or any funding portal unless explicitly stated. Investments in private companies involve risk, including the potential loss of your entire investment. Always conduct your own due diligence and consult a licensed financial advisor before investing.